Alabama offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Alabama Government

600 Dexter Avenue

Montgomery, Alabama 36130

Phone: (334) 242-7100

Fax: (334) 353-0004

[email protected]

Hours: M-F 8:00am – 5:00pm

Alabama Power Company

600 18th Street

North Birmingham, Alabama

Residential Customer Service

(800) 245-2244

Hours: M-F 7:00am – 7:00pm

Business Customer Service

(888) 430-5787

Hours: M-F 7:00am – 6:00pm

Energy Division

Alabama Department of Economic and Community Affairs

401 Adams Avenue, Ste. 580

Montgomery, AL 36104

(334) 242-5292

[email protected]

Hours: M-F 9:00am – 4:00pm

Birmingham Weather Bureau

465 Weathervane Road

Calera, AL 35040

(205) 664-3010

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

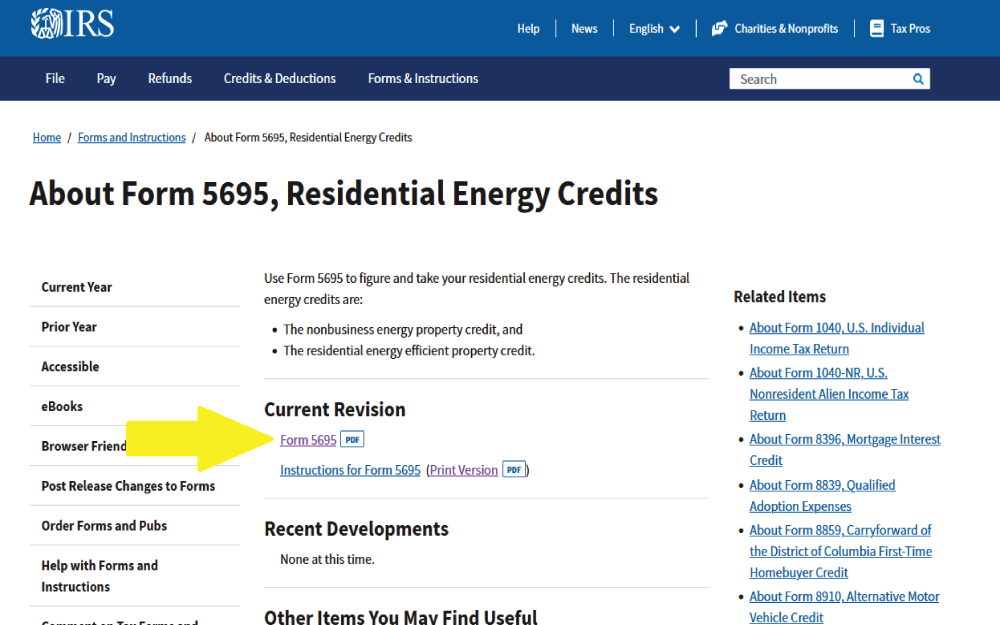

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Alabama Power Company

Billing and Payment Options

Energy Saving

Clean Energy Commitment

Contact

Online Account Management

Service Territory

State Legislature

Power Outage Map

Department of Environmental Management

ADEM Montgomery Office

1400 Coliseum Boulevard

Montgomery, AL 36110-2400

M – F

9:00am – 5:00pm, subject to change

Mailing Address

P.O. Box 301463

Montgomery, AL 36130-1463

Central Laboratory/Field Operations

1350 Coliseum Boulevard

Montgomery, AL 36110-2412

M – F

9:00am – 5:00pm, subject to change

Birmingham Field Office

110 Vulcan Road

Birmingham, AL 35209

M – F

9:00am – 5:00pm, subject to change

(205) 942-6168

Alabama Solar Credits Overview

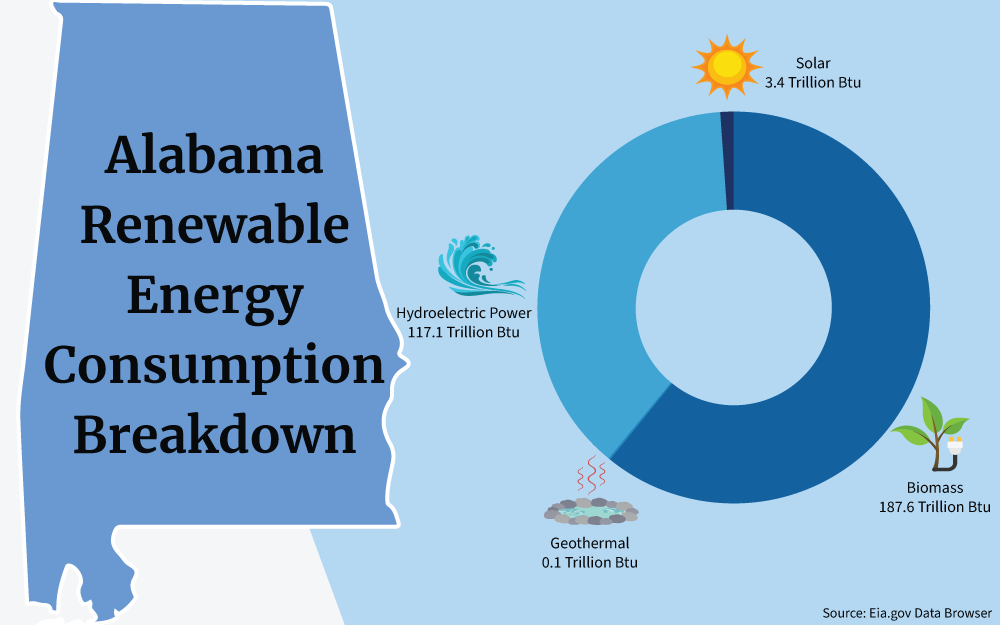

Currently, Alabama gets only a small portion of renewable energy from solar power.

Encouraging residents to install home solar systems is one way that the state can increase these amounts.

As part of the U.S. Alabama solar incentives start with the Federal Solar Investment Tax Credit (ITC).

The federal solar tax credit is one of the nationwide government solar programs that aim at reducing the cost of solar installation by as much as possible.

Ever since its creation in 2005, the ITC has done a fantastic job in making solar systems more accessible not just in Alabama but also in other states in the country.

What Is the Solar Tax Credit in Alabama? (How Does It Work?)

Wondering how solar tax credits work in Alabama? To put it simply, the federal solar tax credit in Alabama helps lower the income tax that you are supposed to pay by as much as 30 percent of the total amount that it costs you to have your solar system installed.4

If you are a taxpayer, you can have 30 percent of the money that you used slashed from your tax liability,7 which is welcome news for any prospective solar owner.

Therefore, the money that you are able to save depends on how much you actually spend to set up the system.

For instance, taking the average cost of solar panels in Alabama into consideration, it basically means that 30 percent of the $28,170 will lead to nearly $9,000 in the value of the credit.

This is the amount that will be deducted from the amount of taxes that you owe the government.

What Do You Need To Apply for the Solar Credit in Alabama?

Of course, there are rules that govern how solar tax credit works, and you have to follow them to the letter (like all IRS forms); if not, you will sadly miss out.

First things first, you have to complete the entire solar conversion process, literally, go through everything, from the financing to the last step, where the equipment is up and running.

You will also need all the details about the installation, which you will likely get from your installation company.

Since the application is made when you are filing your taxes, you will see that you will need to print out a particular form, called the IRS Form 5695,12 that is used to register the credits

How To Apply for the Solar Credit in Alabama

The application process for the tax credit is pretty straightforward and will actually take only a couple of minutes, just as long as you know how to fill in the solar tax credit forms Alabama.

Step 1: When you are certain that you have fully done away with the conversion and your system is working perfectly, you can print out the IRS form 5695 while you are filing your income taxes.

Step 2: Here, you will need all the information that you can get about the installation; the company that got the job done can also help out. Basically, you will need some details like your location, or in other words, where the installation was done, the name of the company, how much you used, and the size of the system.

The Form 5695 instructions are pretty simple,18 but you can always get a professional to help if you get stuck.

Note that these steps are only to be followed when you are manually filing your taxes. If you use software, then the program will be able to automatically inquire about any clean energy installation you did in the past year, and in that case, you don’t really have to go through the printing process of the solar credit form.

NOTE: this form is also used for other renewable energy tax credits, including:

- Solar Heaters

- Wind Energy

- Geothermal Heat Pumps

- Biomass Fuel

EERE Programs Explained: Additional Residential Solar Tax Credits for Alabama

Alabama may not exactly offer some of the most competitive solar incentives in the country, but there are still some Energy Efficiency and Renewable Energy incentives that you can try out.

These rebates, credits and Alabama solar incentives are offered by electrical providers, but there are also some solar companies that offer rebates when purchasing your equipment.

It just depends on where you’re located.

Dixie Electric Cooperative Residential Programs

This utility company goes to great lengths to offer energy audits and incentives for any Alabaman that has installed a clean energy system. It’s not just that.

It is also known to offer loans as a low income solar program,10 partnering with banks to offer affordable solar loan financing that goes towards improving energy efficiency.

Whether or not your local lender offers these loan option can be learned by contacting them.16

Alabama Power Rebates

If you are a customer of Alabama Power,13 you will be able to receive up to $200- $650 in terms of rebates just for installing clean energy systems like heat pumps and smart thermostats.14

The process for obtaining the rebate can be found on the site, and currently includes:

- Smart Thermostat: $200

- Hybrid Water Heaters: $650

- EV Level 2 Home Charger: $500

Central Alabama Electric Cooperative Residential Programs

In addition to Alabama Power, the Central Alabama Electric Cooperative offers residential programs the encourage solar adoption.17

The customers of the company are eligible for a $235-$700 rebate for installing solar-powered systems.

Wiregrass Electrical Cooperative H2O Plus Cashback

The advantage of this Alabama solar incentive offered by Wiregrass Electrical Cooperative,15 is the fact that you are able to receive cashback for setting up energy-efficient equipment.

The amount can range between $300-$400 for every ton you have installed.

How To Choose Solar Panels in AL (What To Consider for Your Home Solar Needs)

Home solar panels are definitely crucial investments. It is not just because the entire installation cost can get pricey, remember that these are equipment that will last you a very long time.

The solar panels lifespan can reach as much as 25 years, and of course, you don’t want anything to go wrong during solar panel installation Alabama.

That is why it is paramount to be very careful when choosing who will install solar power panels for you. There are so many installers in Alabama, but before you settle for one, you may want to consider a few factors first.

Installation Company’s Level of Experience

Solar panel installation is just like any other service, and what is the first thing you go for, a reputable brand right? There are some names that you will often hear when the best solar companies are being mentioned and it is best to give them priority first.

What you need is an installer with an impeccable track record and one that other people can actually vouch for.

Quality of the Materials

Having substandard solar equipment installed may actually be cheaper and save you money upfront but think about the long term and how high maintenance the system is going to get. The best thing that you can do is to make sure that your installer uses only the highest quality materials.

You will find them more long-lasting, by the way, and way more efficient, fully serving their purpose.3

Installation Process for Your Specific Site

One way that you can tell that you are dealing with a professional is that they will be able to outline their entire installation process, from the consultation to the final stages. They are also supposed to give you a timeframe of how long the process is going to take and actually communicate all through.

Incentives and Financing Options

You will notice that there are some solar companies that initiate power purchase agreements, and they will be your top choice if you don’t have the full upfront cost. There are also other local companies that offer incentives for their customers or partner with banks to extend solar loans.

This way, you will be able to get a great deal even when the project is not within your budget.

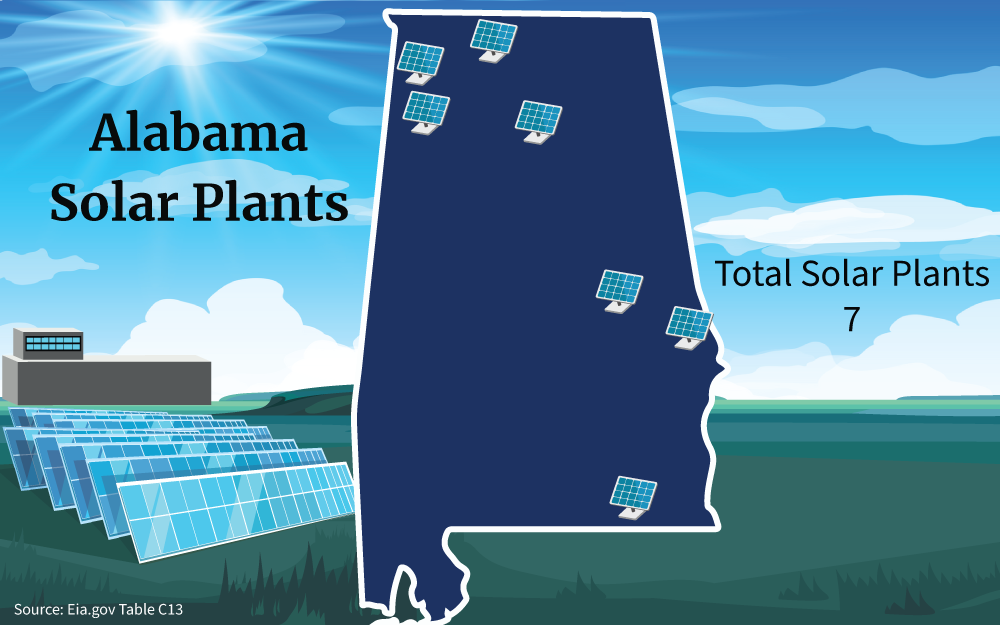

Current Solar Power in Alabama: Solar Farm Locations

Green electricity comes in so many forms, but the common aspect is the fact that it has to come from natural resources, say, sunlight or wind.

Currently, Alabama has 7 existing solar farms in operation. These deliver a very small portion of the state’s renewable energy.

This makes AL a prime candidate for more solar plants, especially for residents who want to disconnect completely from the state power grid.

Solar power in the US, and solar Alabama to be more specific, has been an effective alternative to fossil fuels, and more and more people are starting to consider it, opting out of the grid system.

You may be keen on solar panels information before you consider going solar in Alabama.

You may be wondering, what are solar cells in the first place? And what is PV?

A PV is basically the short form of the term photovoltaic cell or solar cell. In the simplest way possible, this is any gadget that helps transform solar power into electricity.

The solar panel components, which are basically the building blocks of the entire system, all come together to generate power from the sun.

According to the SEIA, Alabama is able to produce more than 1,578 MW of solar in the next few years, mostly through solar farms in Alabama, even though the current rate is only 813 MW.5

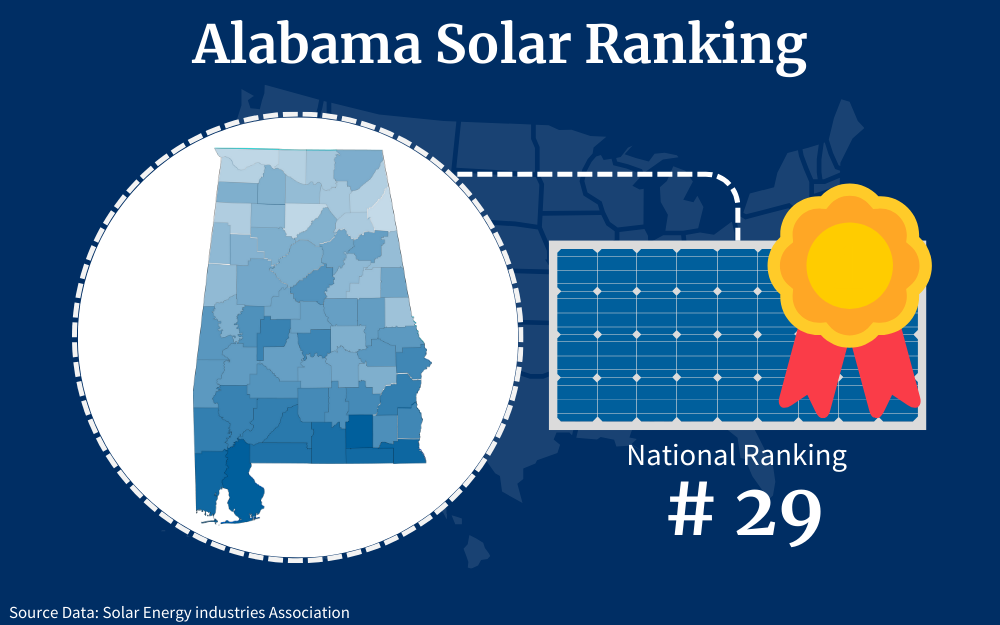

As for the question of solar ranking, Alabama is currently ranked number 29 in the entire nation for solar implementation.

Solar Installation Costs in Alabama Defined

Solar panels are pretty pricey, that is for sure. And to make it even worse, they are not the only components that you need to get your entire system up and running.

Apart from the panels, you will also have to budget for components like the inverters, charge controller, battery, cost of solar panel installation, and other items based on the nature of your installation.

Also some things to consider include:

- Age of your roof

- Slant (slope of the roof)

- Overhanging trees and other obstructions

- The direction of the roof

Your roof plays a role in the cost of home solar installation in Alabama. If there are trees or other obstructions to be removed, those will need to be factored into the cost of solar panels.

Likewise, if your pitches slope roof faces a southerly direction, that can reduce the price of solar panel installation. However, if your roof is flat, old or needs repairs and advanced mounting systems, the solar energy system can be more expensive.

Fortunately, the ITC will include those relevant costs to the amount of the credit you can obtain, if proof is provided that the repair was necessary.

Average AL Solar Installation Costs

If you are a first-timer considering going solar, one of your first questions is going to be, how much do solar panels cost? Well, setting up a solar system in Alabama may be able to set you back about $28,170, that is, if it is an 11-watt setup.

When you look at the numbers, this may mean that you will end up parting with like $2.45 for each and every watt of power that you install.

However, note that this number is not really cast in stone. The good news is that financing solar panels for your home doesn’t have to cost a fortune.8

You may actually end up spending way less than that if you put some factors into consideration. For instance, a smaller or lower-capacity system will definitely cost you less.

Therefore, if you don’t have high energy needs, you can rest easy knowing that the installation will most likely not be that expensive. Going for less efficient or lower-quality materials may also do the trick in lowering the total cost.

How To Use a Solar Savings Calculator To Reduce Solar Expense

There are so many tools online that are at your disposal if you are considering a solar system for home in Alabama.

These calculators can go a pretty long way to answer all the questions that you could possibly have about your system, from its size, the number of panels that will do the job, how much they will cost, and even as far as exactly how much you will be able to save by going solar.

So what do you have to do? Simple.

Just be very open about how much your electricity bill for the month is, how much power is priced in your region for each kWh, and how much power the panels are going to produce, and the system will work out just about everything else from there.

Say you want to figure out how many panels you really need; you will take the total amount of power that you need and then divide it by the average wattage level that is expected from each panel, which is roughly around 320 W.

For instance, if, according to your previous monthly bill, you need a 4 kW energy output, it would mean 4000 W divided by 320 W, giving you a rounded-off figure of 13 panels.

Well, as for the savings, you will take into account the amount of power that your inverter generates within a said period of time, then minus that from the power that you would have otherwise received from the grid. With that, the result will be the free solar that you have consumed.

How Do I Qualify for Alabama Tax Incentives? Who Can Apply?

The federal solar tax credit is no doubt one of the most lucrative single incentives for going solar in the state. However, not many know the rules involved and, sadly, many often end up missing out on it because of some simple issues like not properly filling out the solar credit tax form.

One thing that is worth mentioning is the fact that there is no specific statewide Alabama solar tax credit;1 the one in question is the nationwide incentive that is available in all the 50 US states.

So, first and foremost, who qualifies for solar tax credit?9 Are you a taxpaying citizen of the US?

Do you have a tax liability that you are supposed to pay the government? If the answer is yes to both questions, then you are definitely eligible for the Alabama solar tax incentive.

Another question that can be confusing to first-timers is, can I qualify for the tax credit if someone else installed and used the PV system? The answer is No.

The program is designed in such a way that you can only receive the credit if you are the rightful owner of the system. It must also be a brand-new installation on your own property.

But what about power purchase agreements, you may ask? If you enter a solar leasing contract with a company, you will automatically be out of the eligibility list.

In such instances, the company is the rightful owner of the panels, not you. They cater for everything for you, and you have to pay a certain amount at the end of the year but retain the ownership, so there is absolutely no way that you can claim the solar system as yours when applying for the tax credit.

If you overlook these rules, you may end up being shut out of the program. Lastly, you may ask, what are the individual limits on the federal solar tax credit?

Lucky for you, there is absolutely no limit on the amount that can be payable to you as compensation for installing solar panels in Alabama. As long as your tax liability is sizable enough, you can receive the credit.

But still, if not, the amount can easily roll over to the next year for a maximum of five years in total.

How Does Net Metering Work in Alabama?

One common question among new solar system owners is, can you store solar energy? Absolutely yes!

The whole point of solar is to make energy cleaner, and what better way than by allowing you to save power in your batteries? What this means is that your system will be able to provide power for you even at night or when there are issues with the weather.

Instead of relying on the grid, you can have power when there are outages and the best part is that you will save a lot of money in the process. No more outrageously high energy bills and you can fully rely on your panels for power.

However, one of the negative effects of solar panels is that the storage system can be pretty expensive. But still, there is one way to avoid investing heavily in a battery; you can go for net metering.

Here, you are able to send over some of your excess solar power to the grid and receive it back when you need it at a reduced cost.

While the net metering laws in other states are more favorable, the Alabaman policies are not very welcoming.

Lacking a strong Renewable Portfolio Standard makes the rules more relaxed, such that utility companies like TVA are able to set their own rates, sometimes way lower than normal.2

Why Solar Panels in Alabama Make Sense: Reason To Adopt

If you are on the fence when it comes to making the conversion to solar energy, you will be glad to know that there are plenty of benefits awaiting you as an Alabaman when you go off-grid and entirely rely on your panels for power.11

Solar Power Is Cleaner and Renewable

Governments are now placing a lot of emphasis on cleaner energy sources and shunning fossil fuels. Is solar renewable?

Yes! In fact, it is lauded the world over for being one of the cleanest energy sources with a very low carbon footprint, and if you are keen on eco-conscious movements around the world, converting to solar power is the first step.

It Helps You Reduce Your Energy Bills

Solar energy efficiency against that of the grid system is actually one of its major selling points. The electricity costs in Alabama are astonishingly high, and there is no better way to save money than by converting to cleaner and cheaper electricity.

You can even completely go off-grid and say good riddance to the utility bills. The best part is that the cost of solar panels in Alabama is not that high, and there are also chances of landing used or surplus solar panels that are cheaper.

Solar Energy May Increase Your Property’s Value

Did you know that incorporating solar power plans into your home can significantly increase its market value? That a house with a working solar system actually has a higher value than a regular house using grid power?

Buyers are willing to offer an additional $15,000 for a solar-powered home,6 so, if you are planning to resell your house later on, think of solar panels as an investment.

Are you trying to find a way out of paying the high utility bills? Why don’t you consider solar in Alabama?

Your neighbors are already installing panels, and you can join them in lowering and eliminating your electricity bills too. But what about the cost of installation?

The good news is that the introduction of government solar programs like the Alabama solar tax credits has gone a really long way to help make solar panels in Alabama more affordable. You might actually end up saving quite a lot of money, and the system will no longer seem as expensive as you think.

Imagine getting as much as 30% slashed from your installation; seems like a pretty sweet deal, right?

Just as long as you correctly fill out the federal solar tax credit form and meet all the eligibility criteria. The best time to take advantage of that is now.

Solar power may never be this affordable, thanks to Alabama solar incentives that are designed to reduce the costs of installation, and you can register for the solar tax credit rebate now.

Frequently Asked Questions About Alabama Solar Incentives

Is There a Statewide Alabama Solar Tax Credit?

Unfortunately, Alabama currently doesn’t have a state-level solar tax credit. The only one available for you to make full use of is the nationwide federal solar tax credit that offers 30% credit on the total installation cost of your new panels; this is the most lucrative tax credit you can maximize as an Alabaman.

Is the Cost of Solar Panels in Alabama Worth It?

Is paying more than $20,000 for a solar panel system worth it in Alabama? Definitely, yes, especially if you consider all the upsides like savings from reduced electricity expenses and independence from the grid, while also making a significant positive impact on the environment.

Are There Free Solar Panels in Alabama?

As much as many would appreciate free solar panels Alabama, there is no such program in the state currently. The closest that you can come to saving as much money on the upfront cost as possible is if you sign up for a solar lease, but even so, you will still have to pay some money at the end of the month, so technically, it isn’t exactly free.

References

1Compass Solar Energy. (2023). Alabama Tax Credits | Compass Solar Panels Pensacola. Compass Solar Energy. Retrieved August 18, 2023, from <https://compasssolar.com/Alabama-tax-credits/>

2Olizarowicz, B. (2023, August 3). Alabama Solar Incentives: Tax Credits & Rebates Guide (2023). Today’s Homeowner. Retrieved August 18, 2023, from <https://todayshomeowner.com/solar/guides/Alabama-solar-incentives/>

3Smart Energy USA. (2023). 7 Best Solar Companies in Alabama by Reviews in 2023. Smart Energy USA. Retrieved August 18, 2023, from <https://smartenergyusa.com/best-solar-companies-in-Alabama/>

4Simms, D. (2023, August 22). Alabama Solar Incentives (Rebates, Tax Credits & More in 2023). EcoWatch. Retrieved August 22, 2023, from <https://www.ecowatch.com/solar/incentives/al>

5Solar Energy Industries Association. (2023). State-By-State Map. SEIA. Retrieved September 7, 2023, from <https://www.seia.org/states-map>

6Blue Raven Solar. (2021, May 27). 10 Key Benefits of Going Solar. Blue Raven Solar. Retrieved August 18, 2023, from <https://blueravensolar.com/blog/10-key-benefits-of-going-solar/>

7Solar Energy Technologies Office. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Energy Efficiency & Renewable Energy. Retrieved September 1, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

8Solar Energy Technologies Office. (2021, August 17). Money Matters: How to Finance Your Rooftop Solar Energy System. Energy Efficiency & Renewable Energy. Retrieved September 1, 2023, from <https://www.energy.gov/eere/solar/articles/money-matters-how-finance-your-rooftop-solar-energy-system>

9Internal Revenue Service. (2023, August 28). Residential Clean Energy Credit. Internal Revenue Service. Retrieved September 1, 2023, from <https://www.irs.gov/credits-deductions/residential-clean-energy-credit>

10National Renewable Energy Laboratory. (2023). Low- and Moderate-Income Community Solar Policies. National Renewable Energy Laboratory. Retrieved September 1, 2023, from <https://www.nrel.gov/state-local-tribal/lmi-solar.html>

11Energy Saver. (2023, February 13). 5 Benefits of Residential Solar. Energy Saver. Retrieved September 1, 2023, from <https://www.energy.gov/energysaver/articles/5-benefits-residential-solar>

12U.S. Internal Revenue Service. (2022, December 6). Residential Energy Credits [PDF File]. IRS. Retrieved September 10, 2023, from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

13Southern Company. (2023). Solar Energy. Alabama Power. Retrieved September 10, 2023, from <https://www.alabamapower.com/smart-energy/sustainability/renewables/solar-energy.html>

14Southern Company. (2023). Rebates & Incentives. Alabama Power. Retrieved September 10, 2023, from <https://www.alabamapower.com/residential/save-money-and-energy/energy-saving-products/rebates-and-incentives.html>

15Wiregrass Electric Cooperative. (2023). H2O Plus Program FAQ. Wiregrass Electric Cooperative. Retrieved September 10, 2023, from <https://www.wiregrass.coop/faqs_category/h2o-plus-program-faq/>

16Dixie Electric Cooperative. (2023). Co-op Energy Efficiency Program. Dixie.coop. Retrieved September 13, 2023, from <https://www.dixie.coop/energy-efficiency-program>

17Central Alabama Electric Cooperative. (2023). Green Power Choice Program. Central Alabama Electric Cooperative. Retrieved September 13, 2023, from <https://caec.coop/member-benefits-services/green-power-choice-program/>

18Internal Revenue Service. (2023). 2022 Instructions for Form 5695. IRS. Retrieved September 13, 2023, from <https://www.irs.gov/pub/irs-pdf/i5695.pdf>

19Photo by Dennis Schroeder, National Renewable Energy Laboratory. U.S. Department of Energy. Retrieved from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

20Screenshot of About Form 5695. Internal Revenue Service. Retrieved from <https://www.irs.gov/forms-pubs/about-form-5695>